25+ hud subordinate mortgage

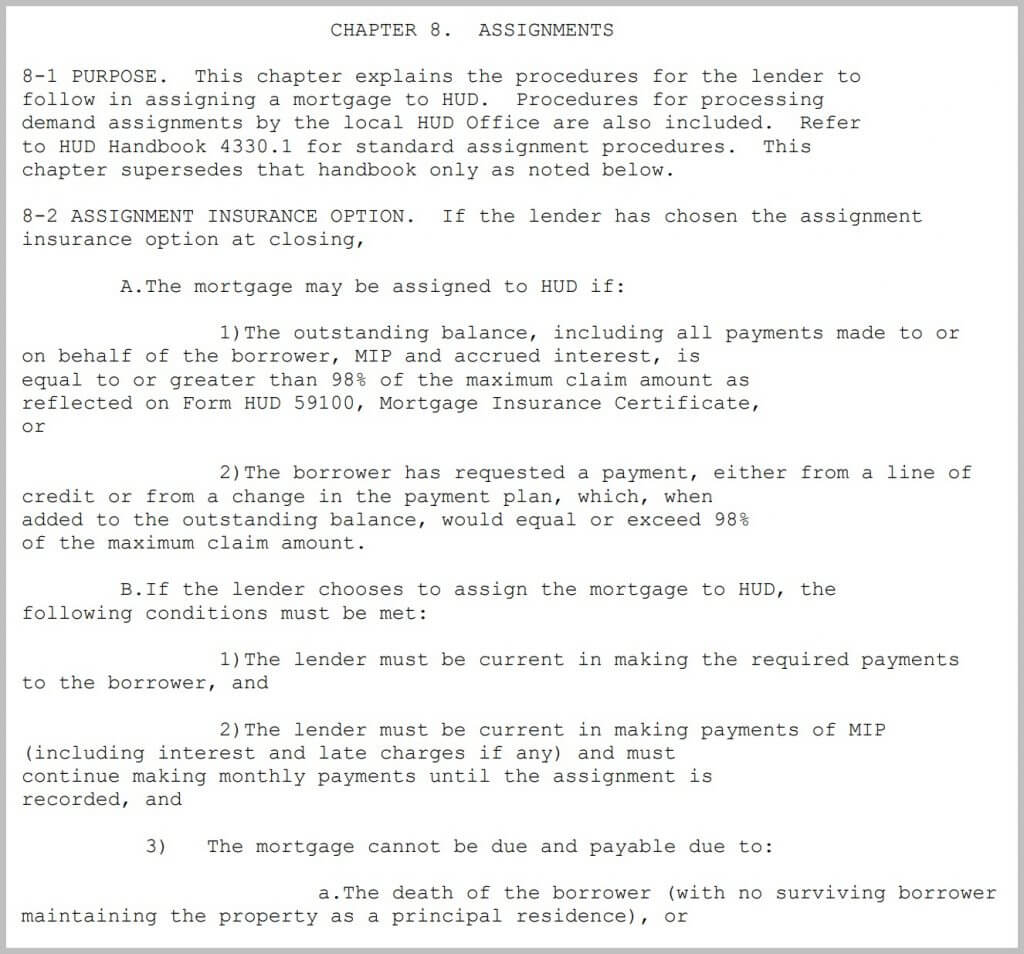

Web The mortgagor must execute a mortgage in favor of HUD with terms and conditions acceptable to HUD for the amount of the partial claim under 203414 a. FHA assists first-time homebuyers and others who might be unable to meet down payment requirements for conventional loans providing mortgage insurance to private lenders.

:max_bytes(150000):strip_icc()/shutterstock_260703998-5bfc4799c9e77c002636c989.jpg)

Hud Vs Fha Loans What S The Difference

HUD Partial Claim HUD Loss Mitigation Assistance GNND Good Neighbor Next Door EHLP Emergency Homeowners Loan Program HUD 235 Loan Recaptures Nehemiah Program Loans HUD REO ACA Rehabilitation Assistance HOPE for Homeowners H4H Mortgages.

:max_bytes(150000):strip_icc()/dotdash-hud-vs-fha-loans-whats-difference-Final-0954708337654015b47b723ebc306b0f.jpg)

. 41551 5C3b Secondary Financing by a. Web A HUD subordinate mortgage loan type may be one of the following. Along with the prescribed application for.

Web A HUD or the PAE may approve the payment to the owner of up to 25 percent of net cash flow based on consideration of relevant conditions and circumstances including but not limited to compliance with the management standards prescribed in 401560 and the physical condition standards prescribed in 401558. HUD may require the mortgagee to be responsible for servicing the subordinate mortgage on behalf of HUD. When you get the loan you need to purchase your home this loan is typically recorded as the first repayment priority on your deed after closing.

Web For all borrowers that cannot resume their monthly mortgage HUD will enhance servicers ability to provide all eligible borrowers with a 25 PI reduction. Types of subordinate financing include home equity loans home equity line of credit HELOC and second mortgages. Web Yes the Subordination Agreement HUD-92420M should be used to subordinate all governmental secured second mortgages including HUD-held second mortgages such as those used to secure Mark-to-Market restructuring or Partial Payment of Claim notes.

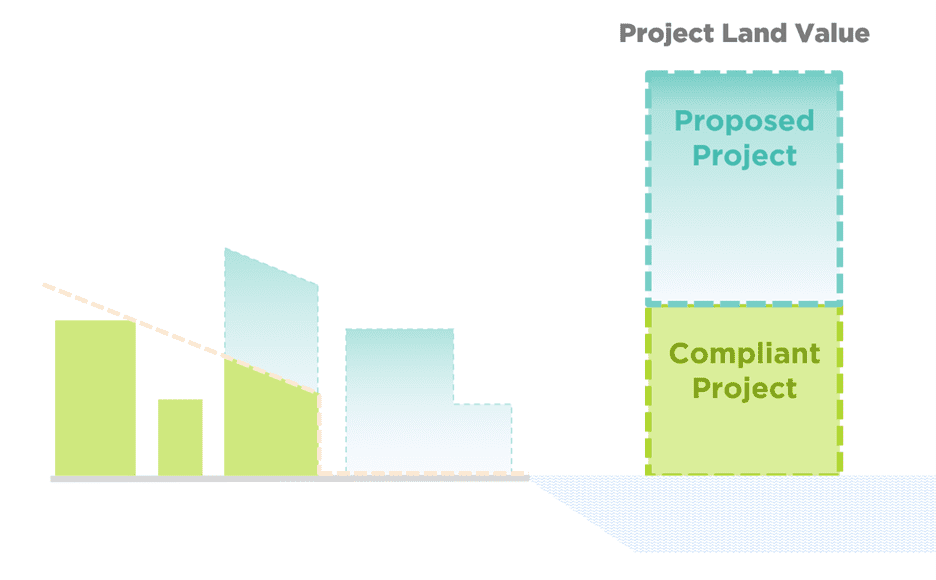

Web A mortgage subordination refers to the order the outstanding liens on your property get repaid if you stop making your mortgage payments. Web Acceptable Subordinate Financing Types. Web What is Subordinate financing.

Mortgages with deferred payments in connection with employer subordinate financing see below. The order of subordination is determined based on the type of loan against your property. For example your first home loan primary mortgage is repaid first with any remaining funds paying off additional liens including second mortgages HELOCs and home equity loans.

Web In addition a local real estate agent can help you with possible financing options and get you pre-qualified to buy a HUD home andor foreclosure. D Application for insurance benefits. Web Subordinate mortgages are loans that have a lower priority status than any other recorded liens or debts against a property.

Web A HUD certified housing counselor can assist homeowners by. Web The US Department of Housing and Urban Development issued Mortgagee Letter 2009-49 to provide guidance for addressing FHA requirements for secured subordinate financing under the Federal Housing. Web A HUD subordinate mortgage loan type may be one of the following.

Identifying who services the homeowners mortgage See MERS ServiceID website. The monthly payments under the insured mortgage and second lien plus housing expense and other recurring charges cannot exceed the borrowers ability to repay. Reviewing the homeowners financial situation and mortgage information and evaluating which loss mitigation options may be available.

The first mortgage is considered your senior mortgage and takes priority over all others. Web Mortgage subordination boils down to a ranking system on the liens secured by your home. A lien is a legal agreement that grants the lender a right to repossess the property if you default on the loan.

Web With advance approval FHA will insure a first mortgage loan on a property that has a second mortgage held by an approved nonprofit agency. Any mortgage or other lien that has a lesser priority than that of the first mortgage. Mortgages with regular payments that cover at least the interest due so that negative amortization does not occur.

HUD Partial Claim HUD Loss Mitigation Assistance GNND Good Neighbor Next Door EHLP Emergency Homeowners Loan Program HUD 235 Loan Recaptures Nehemiah Program Loans HUD REO ACA Rehabilitation Assistance HOPE for Homeowners H4H Mortgages. Variable payment mortgages that comply with the details below.

Roboforex Statements Pdf Exchange Traded Fund Financial Services Companies Of The United States

Orix Tci Petition For Review And Appendix File Stamped Pdf Lawsuit Standing Law

:max_bytes(150000):strip_icc()/dotdash-hud-vs-fha-loans-whats-difference-Final-0954708337654015b47b723ebc306b0f.jpg)

Hud Vs Fha Loans What S The Difference

The Leader Feb 25 2010 By The Leader Issuu

Hud Assesses The State Of Small Mortgage Lending Themreport Com

Hra Editor Author At Hr A Page 2 Of 17

Fha Hud Healthcare Loans Capital Funding Group

Pdf Does Mandatory Disclosure Affect Subprime Lending To Minority Neighborhoods

Mortgage Rescue Homeownership Center Assistance A Program Of St Mary Development Corporation Ppt Download

Pdf Double Jeopardy Why Latinos Were Hit Hardest By The Us Foreclosure Crisis

Behavioral Finance Jaffw2008 Pdf Behavioral Economics Arbitrage

Opdata Usall Csv At Master Bwzx Opdata Github

What Happens When A Reverse Mortgage Is Assigned To Hud

Federal Legal Issues 7 Ppt Download

What Happens When A Reverse Mortgage Is Assigned To Hud

Pace Financing For Solar Projects Lg Usa Business

Hra Editor Author At Hr A Page 2 Of 17